Home

/

0

Annual fees

0

Effectiveness of use

Privileges are only for Eximbank cardholders

Along with a series of other amenities

Transaction safety

Using EMV Chip technology to secure cardholder information and ePIN with passwords provided or self-generated via SMS and Eximbank EDigi

Withdraw money anywhere

Eximbank ATMs and ATMs of NAPAS banks in Vietnam

Convenient payment

Pay bills, utility services: electricity, water, phone, Internet...

Diverse shopping

Directly at card acceptance points and online channels

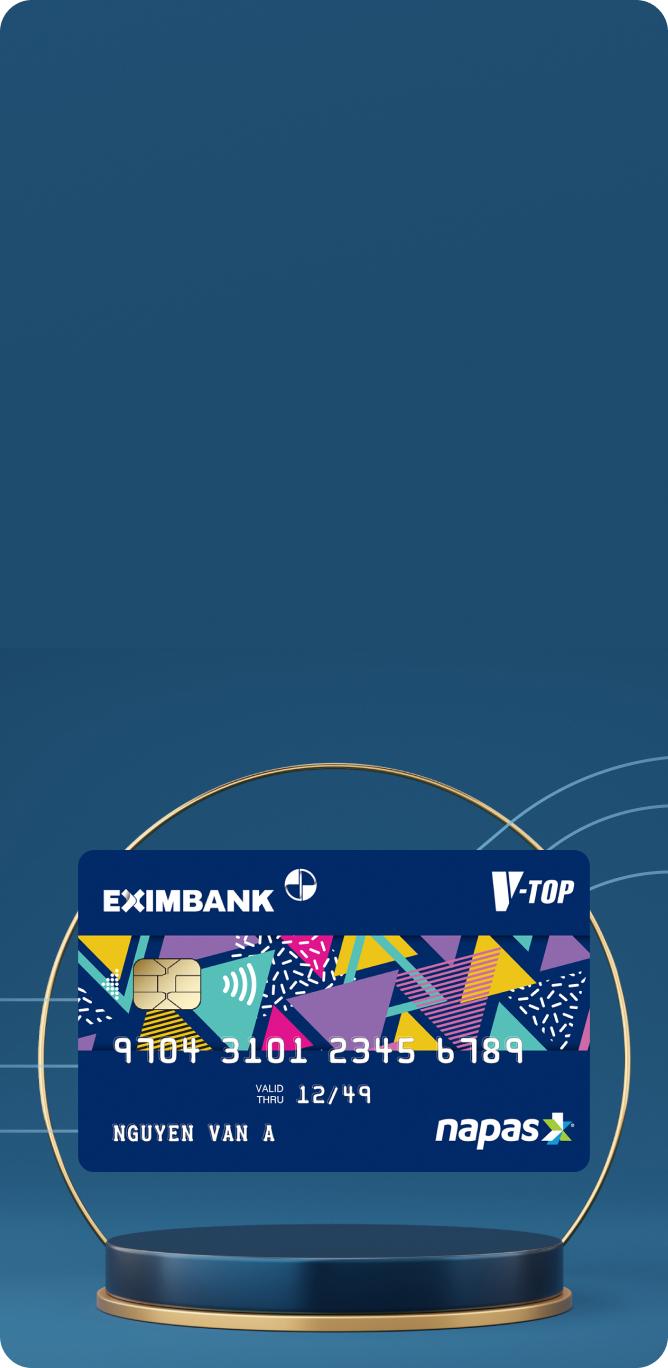

Product information

Purpose

- Withdraw cash at ATMs in the Eximbank system and member banks, view balances, print statements and transfer funds, etc.

- Unused money still earns interest every day.

Utilities

- Pay for goods and services at card acceptance points and on linked websites.

- Pay bills, utility services: electricity, water, phone, Internet...

Open a card now to receive attractive incentives

Competitive interest rates

Attractive interest rates, along with competitive fees.

Open flexible cards

Diverse methods of opening cards, from opening cards at the counter to registering online.

Fast approval

Get a card with simple documents and fast approval time.

Frequently asked questions